2024 Irs 1040 Schedule 4 Fillable

2024 Irs 1040 Schedule 4 Fillable – The IRS Free File program provides free tax filing services to many lower and middle income taxpayers through IRS trusted partners. To qualify for IRS Free File guided tax software, individuals, . If your business sold any capital assets, profitable or not, you will have to report it to the IRS using Schedule D you will need to complete Form 1040 through line 43 to calculate your .

2024 Irs 1040 Schedule 4 Fillable

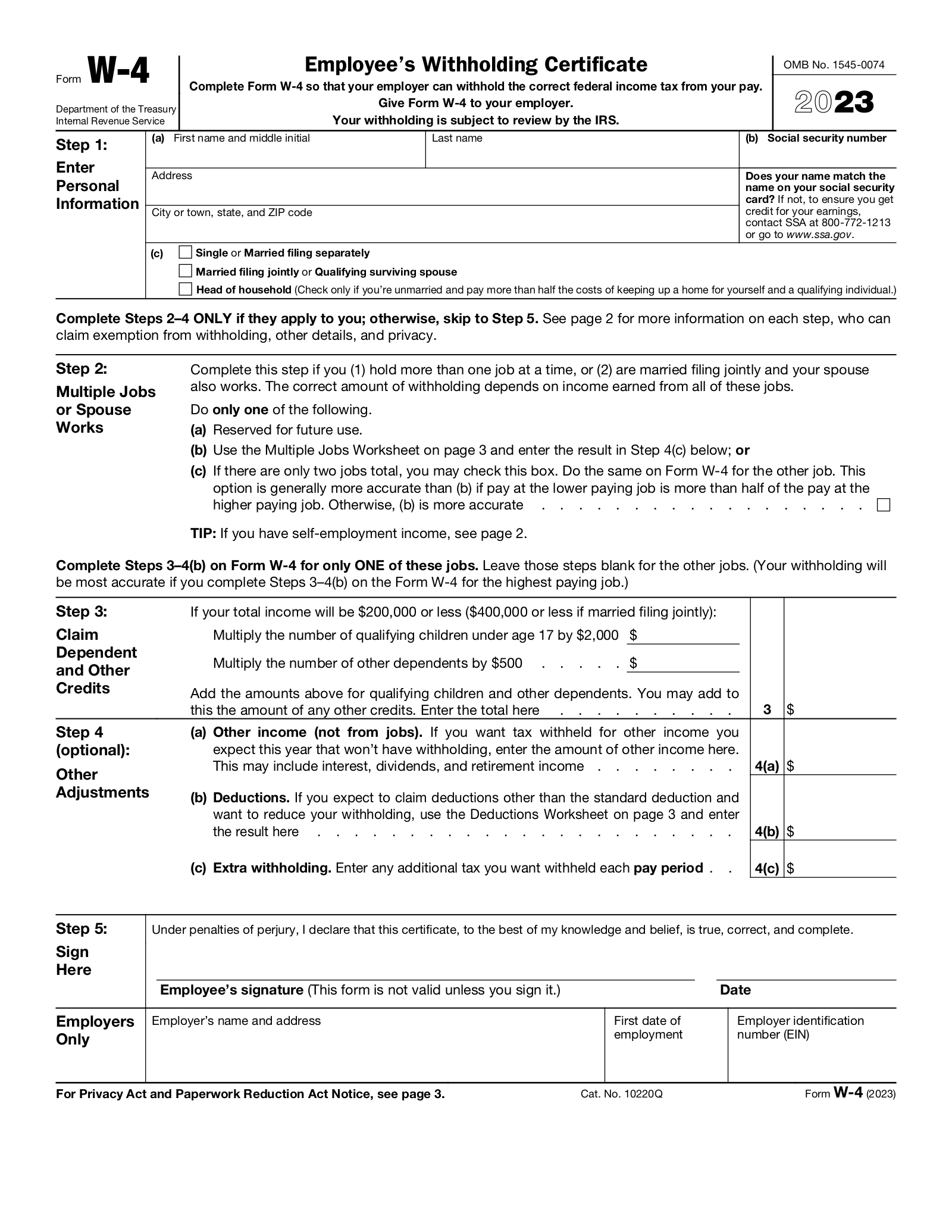

Source : www.irs.govPublication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov2024 Form W 4P

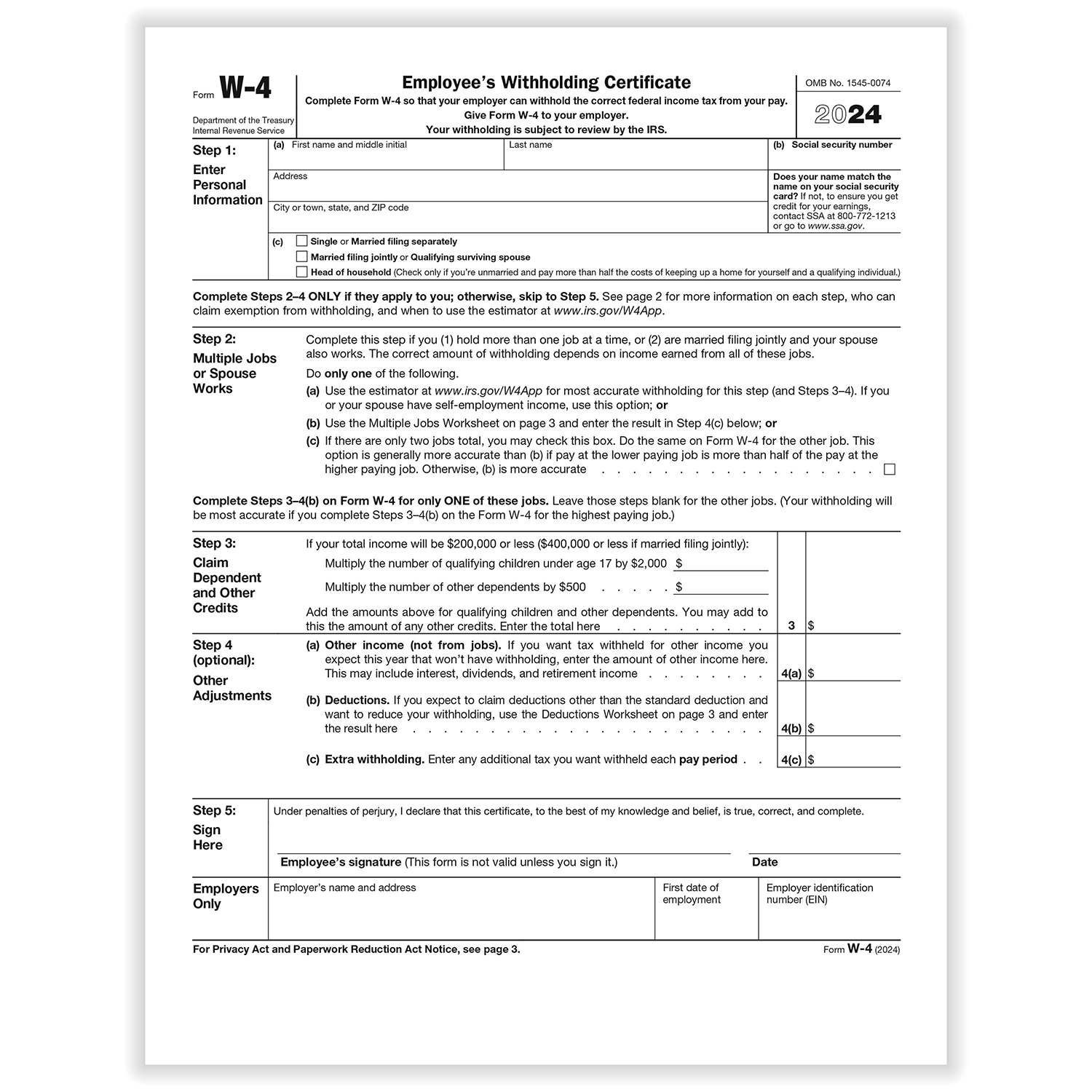

Source : www.irs.gov2024 IRS W 4 Form | HRdirect

Source : www.hrdirect.comFirefighter Challenge Championship Series | Rogersville AL

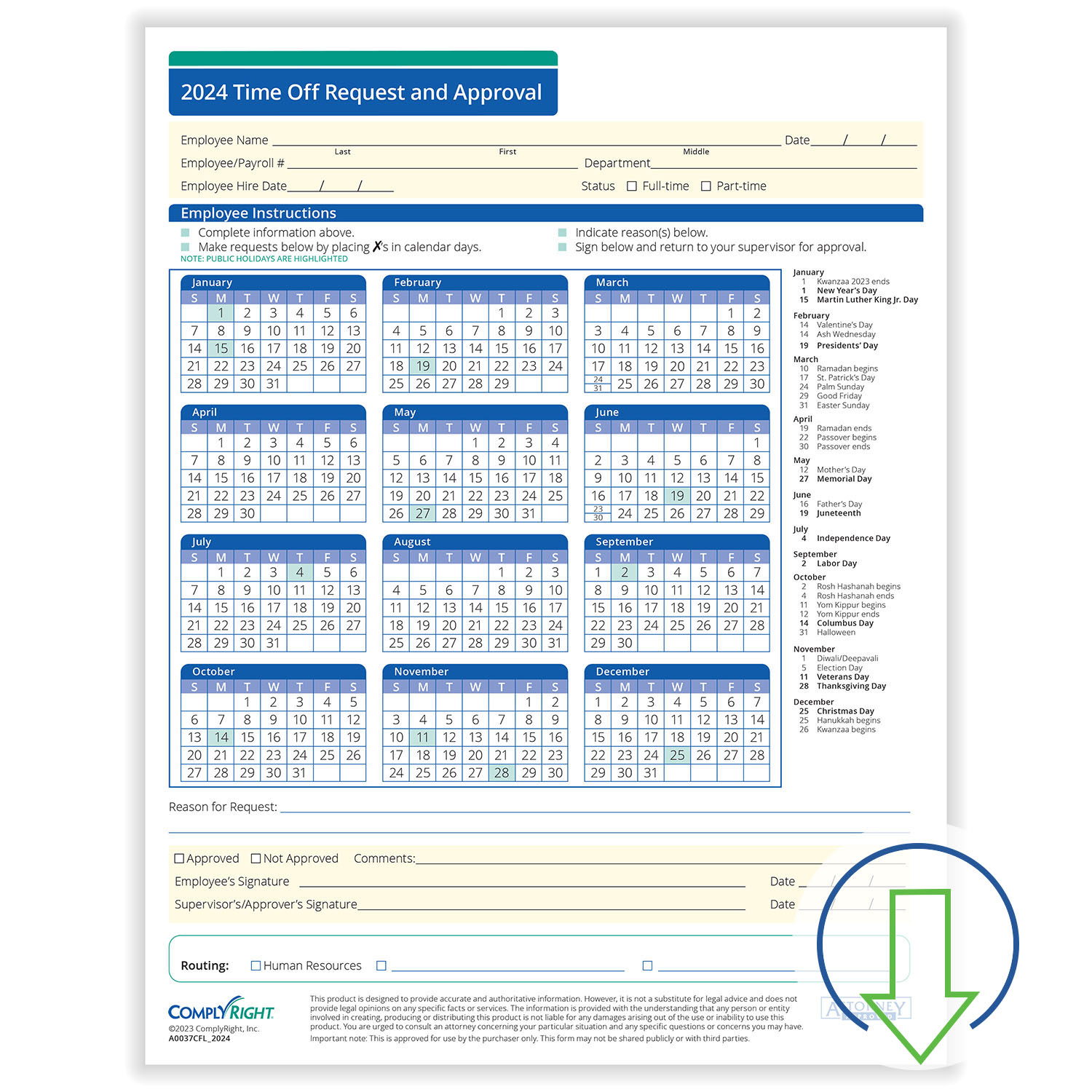

Source : www.facebook.com2024 Downloadable Time Off Request and Approval Form | HRdirect

Source : www.hrdirect.comIRS Releases 2024 Form W 4R | Wolters Kluwer

Source : www.wolterskluwer.comFree IRS Form W4 (2024) PDF – eForms

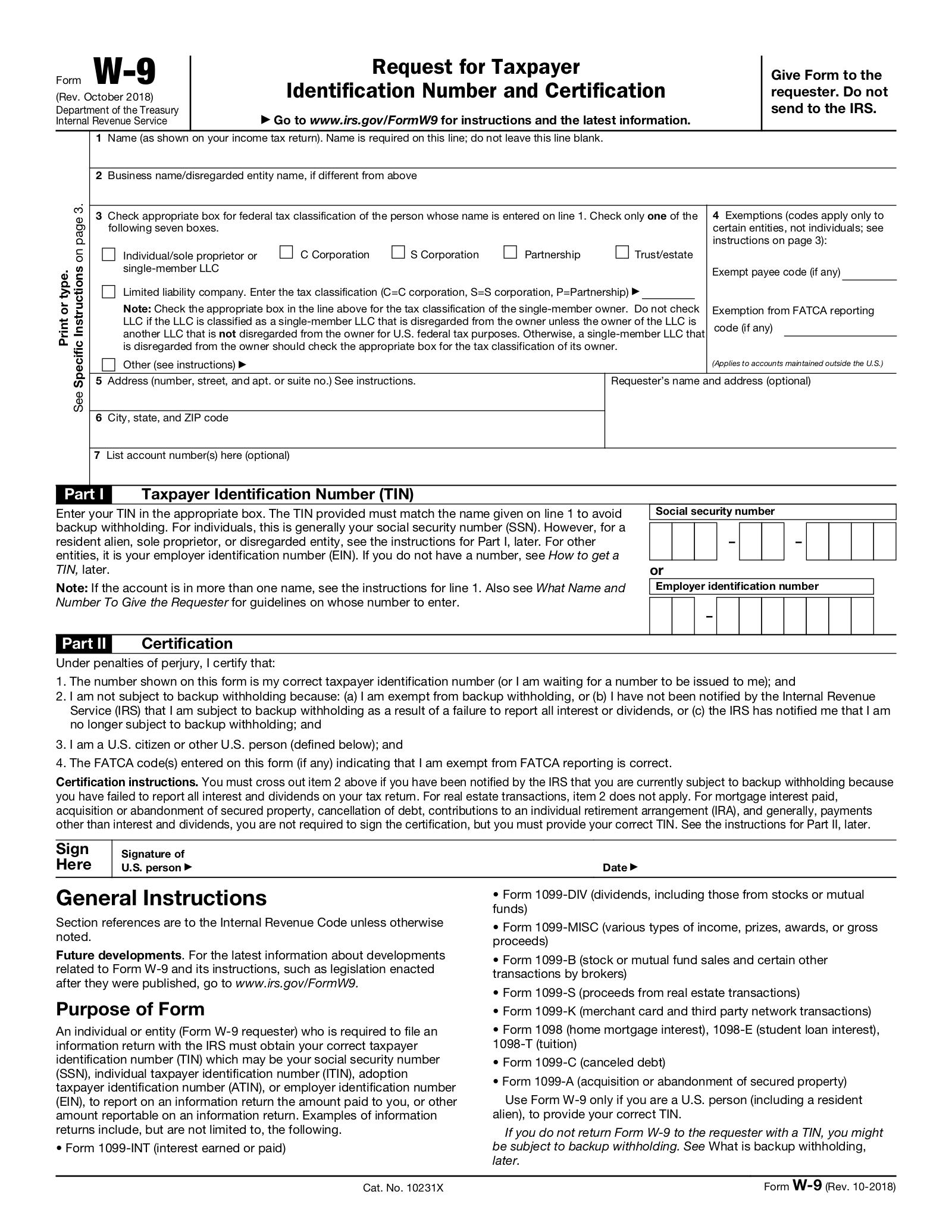

Source : eforms.comW 9 Tax Form 2018/2024 Fill Out Online & Download Free [PDF]

Source : www.pandadoc.comFree IRS Form W9 (2024) PDF – eForms

Source : eforms.com2024 Irs 1040 Schedule 4 Fillable Employee’s Withholding Certificate: For those confident enough to file without guidance, the agency also offers free fillable for the four tax preparation providers that NerdWallet reviews. 1040, Schedule 1, 2, and 3 (limited . Depending on the type of activity, you’ll report your crypto gains and losses on Form 1040 Schedule to prepare your Schedule D for tax reporting purposes. Crypto Tax Myth #4 – If you hold .

]]>